Business Insurance in and around Grapevine

Grapevine! Look no further for small business insurance.

Almost 100 years of helping small businesses

- Grapevine

- Colleyville

- Southlake

- Hurst

- North Richland Hills

- Bedford

- Euless

- DFW

- Tarrant County

- Fort Worth

- Dallas

- Keller

- Mid Cities

- Dallas Fort Worth

- North Texas

- Dallas County

- Irving

- Watauga

- Coppell

- Arlington

Coverage With State Farm Can Help Your Small Business.

Running a small business is hard work. Insuring your venture should be the least of your worries. State Farm insures small businesses that fall under the umbrella of retailers, contractors, trades and more!

Grapevine! Look no further for small business insurance.

Almost 100 years of helping small businesses

Small Business Insurance You Can Count On

When one is as passionate about their small business as you are, it is understandable to want to make sure everything has been thought of. That's why State Farm has coverage options for commercial auto, surety and fidelity bonds, worker’s compensation, and more.

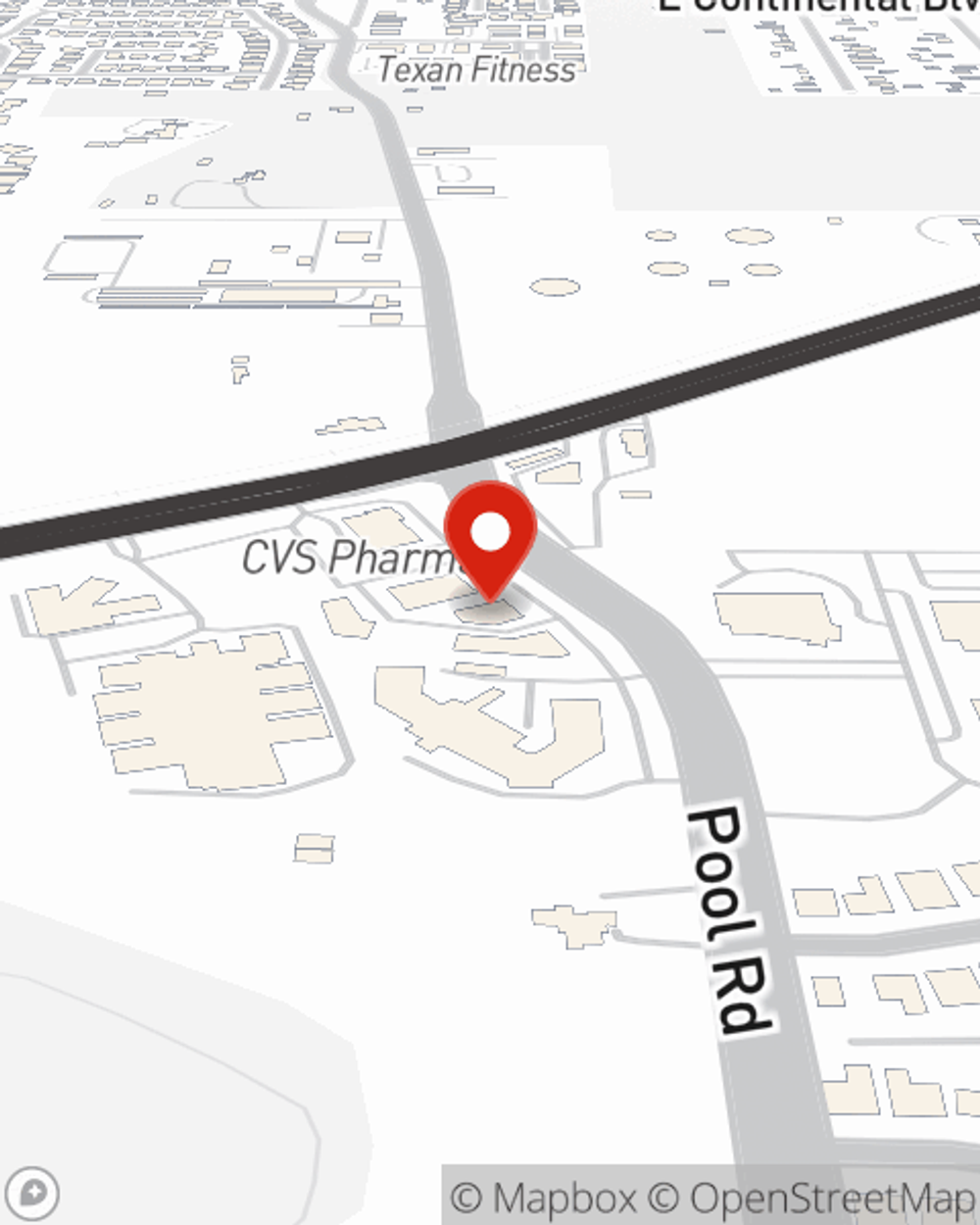

The right coverages can help keep your business safe. Consider calling or emailing State Farm agent Ed Lair's office today to identify your options and get started!

Simple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Ed Lair

State Farm® Insurance AgentSimple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.